Floating Wind: The Next Big Leap in Clean Energy

In the race to achieve net-zero carbon emissions by 2050, the world is witnessing an unparalleled acceleration in renewable energy conversion. A significant portion of this green energy transformation is set to arise from offshore wind, with a particular spotlight on floating wind technologies. This piece delves into the promising trends shaping the floating wind sector and the countries propelling this innovative technology.

1. The Emergence of Floating Wind

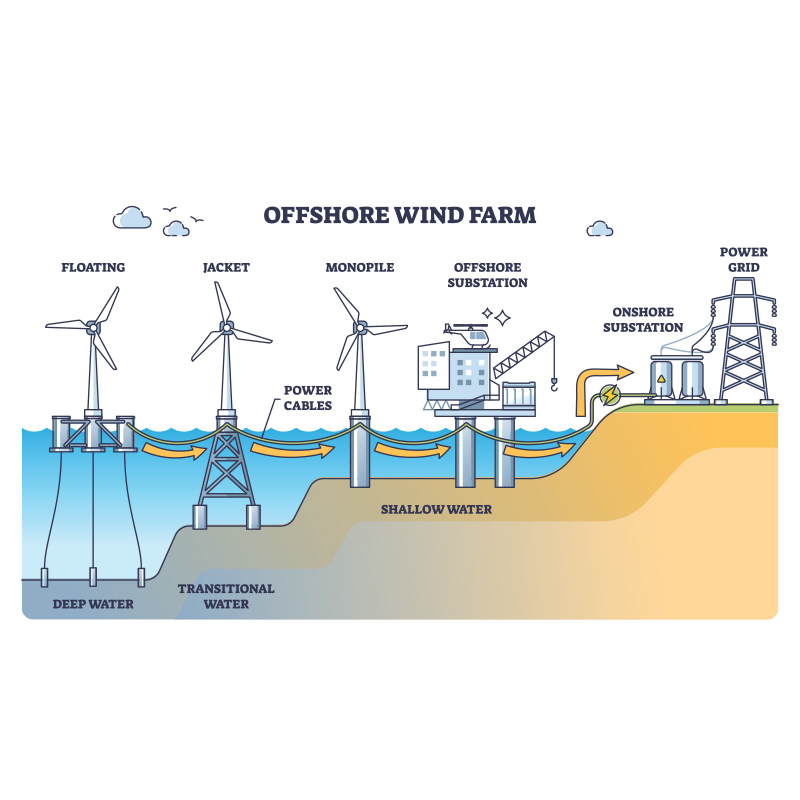

Floating wind farms are a relatively new entrant in the renewable energy landscape. Unlike their fixed-bottom counterparts, these structures leverage turbines positioned onto floating platforms, subsequently anchored to the seabed via mooring lines. This design is optimal for deep waters, where traditional fixed farms are impractical.

The genesis of floating wind can be traced back to 2009, with the initiation of the Hywind 1 project off Norway's coast. Fast forward to 2017, and we saw the world's first floating wind farm, Hywind Scotland, start operations. Today, over 40 distinct floating wind platform concepts are under development, signalling a radical transformation in the sector.

2. The Potential of Floating Wind

Floating wind holds immense potential for countries or regions previously constrained by water depth. For instance, commercial-scale farms could become a reality off the coast of the South West of England, Wales, Northern Ireland, Scotland, and the Northern North Sea.

Furthermore, floating wind farms can be located further out to sea where winds are stronger and more consistent. This positioning means they can generate more power than those fixed to the seabed near the shore. They are also less visible from the coast, mitigating the risk of opposition from local communities.

3. The Role of Policy and Investment in Floating Wind Development

For floating wind to become a commercial reality, significant investment and policy decisions are needed. Industry experts suggest that developments and decisions made in 2023 will be pivotal in dictating the success of floating wind adoption over the next decade.

Around 80% of the world's offshore wind power potential resides in waters deeper than 60 metres, according to the Global Wind Energy Council (GWEC). This means floating turbines will be crucial for countries with limited land space and steep coastal shelves to decarbonise their power sectors.

4. The Evolution of Floating Wind Technology

The technology behind floating wind is still evolving, with a key focus on large-scale deployment, de-risking technology challenges, and identifying innovative solutions for cost reduction.

In terms of turbine capacity, floating wind has seen a significant increase. For instance, the Siemens Gamesa SG 14-236 DD turbine, with a 43,500m2 swept area, can generate enough electricity annually to power 18,000 European homes for a year. Over the next five years, substantial technology development in floating wind is expected to reduce cost, scale production, and broaden applicability.

5. The Cost Challenges of Floating Wind

Unfortunately, it's not all plain sailing for the floating wind sector. Rising costs and supply chain bottlenecks have impacted some projects, and without investment in infrastructure to launch the vast turbines and tow them to sea, harnessing the full power of the ocean's winds could prove challenging.

However, the industry remains optimistic about floating wind's future cost competitiveness. Current models suggest that by 2035, the Levelised Cost of Energy (LCOE) for floating wind is expected to decrease to about 60 euros/MWh, making it a viable competitor with other energy technologies.

6. The Market Growth of Floating Wind

Market growth for floating wind is set to explode in the coming years, with new tenders being launched in various countries. At the end of 2022, plans for about 48 gigawatts (GW) of floating wind capacity were in place around the world, nearly double the amount in the first quarter of the same year.

Industry forecasts predict that by 2050, floating wind will represent 15% of all offshore wind capacity. However, wind turbine manufacturers are currently grappling with rising demand due to inflation and raw material costs.

7. Country-Specific Floating Wind Initiatives

Several countries are already setting ambitious targets for floating wind. The United States, for instance, wants to develop 15 GW of floating offshore wind capacity by 2035. Japan plans to install up to 45 GW of offshore wind capacity by 2040, including floating turbines. South Korea is aiming for 9 GW of floating wind by 2030, while Spain seeks up to 3 GW of floating capacity by 2030.

The UK, a long-time advocate of offshore wind, has set a target of reaching 50GW of offshore wind by 2030 under its British Energy Security Strategy, with floating wind constituting 5GW of this target.

8. The Economic Impact of Floating Wind

The economic implications of floating wind are promising. In the UK alone, the creation of floating wind farms in the Celtic Sea could potentially create 3,000 jobs and provide £682 million in supply chain opportunities for Wales and Cornwall by 2030. Across the UK, it is estimated to generate 17,000 jobs and £33.6 billion by 2050.

9. Infrastructure Challenges for Floating Wind

One of the biggest challenges floating wind faces is the availability of large ports to assemble the turbines and transport them to sea. Ideally, ports where towers measuring more than 150 metres to the rotor's centre and their giant floating bases can be manufactured and assembled are needed.

In many countries, such ports are sorely lacking. For instance, a report by the UK Floating Wind Offshore Wind Taskforce stated that up to 11 ports would need transformation into hubs to enable the roll-out of floating offshore wind at scale, requiring an investment of at least £4 billion.

10. The Future of Floating Wind

Despite the challenges, the future of floating wind looks promising. With technological advancements, increased investment, and government support, the sector is poised for significant growth.

Countries like the UK are expected to lead this industry, but many European countries are looking to follow suit as a way of expanding and diversifying their energy mix. Growth in floating wind promises to bring economic development, jobs, and secure energy supply. More importantly, it offers hope for reducing emissions, reaching environmental commitments, and limiting the most extreme impacts of climate change.